- #REVIEW QUICKEN FOR PERSONAL USE HOW TO#

- #REVIEW QUICKEN FOR PERSONAL USE ANDROID#

- #REVIEW QUICKEN FOR PERSONAL USE SOFTWARE#

- #REVIEW QUICKEN FOR PERSONAL USE FREE#

Mint is one of the most widely used budgeting and cost management programs.

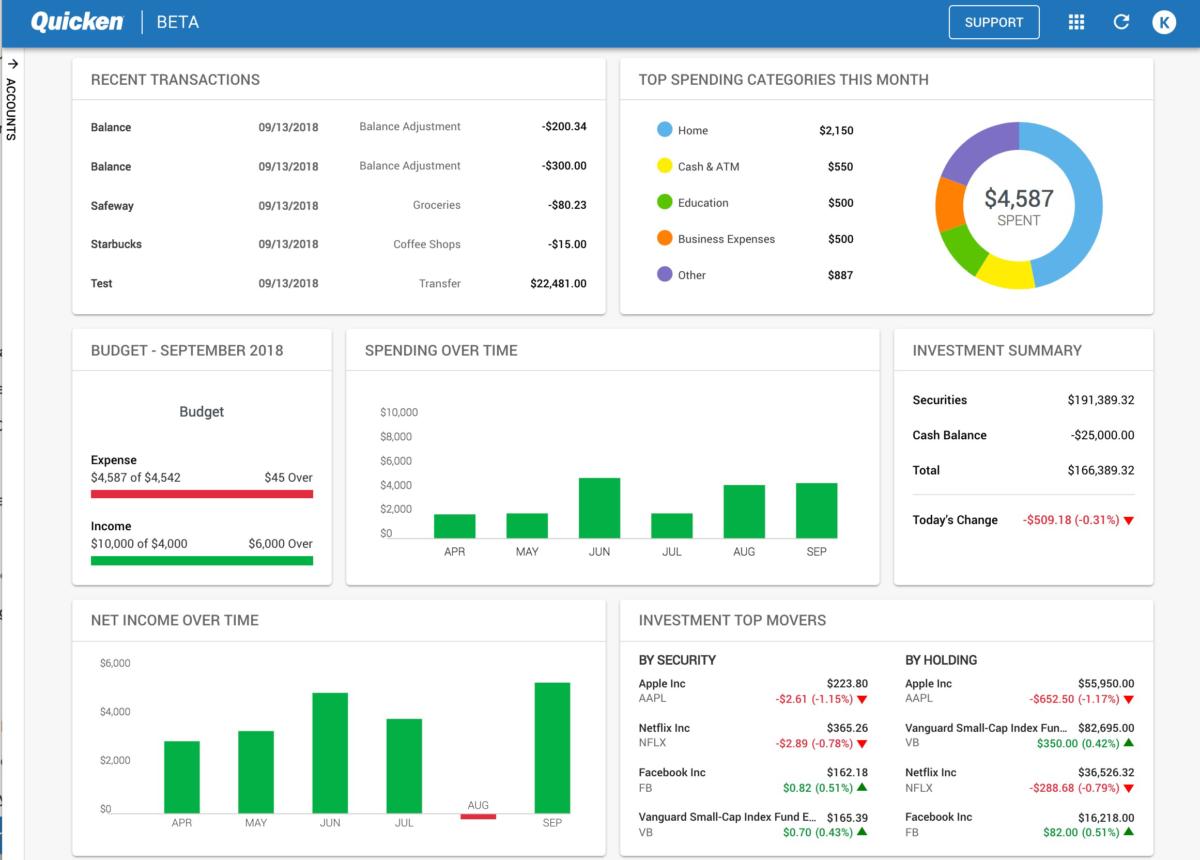

You can view your balances, budgets, accounts, and transactions.To summarize, the core features it offers to help you manage your expenses are as follows: Excel reportingĮxcel exporting is available in the app, allowing you to modify and conduct multiple calculations on your files. Its preparation feature also enables users to view tax records and bank account expenditures. Rent payment mechanisms are included in the product, allowing businesses to monitor unpaid payments and submit rent receipts to tenants. You can also use it to keep track of the worth of your assets so that you can calculate your overall net worth accurately. Its dashboard, which is designed for companies of all sizes, allows users to keep track of tenant lists, income/expenses, bank balances, records, and loans. Users can save contact details for tenants, rental rates/agreements, security deposits, and lease conditions. The app can be used to monitor different facets of your financial life, including budgeting, debt monitoring, savings targets, and even investment counseling. Customer Support is provided via documentation, phone, email, and an online help desk and is available monthly. Quicken does care about its customers and is available to resolve any issues and inconveniences they might come across.

#REVIEW QUICKEN FOR PERSONAL USE ANDROID#

It is available for Windows, macOS, iOS, and Android and costs $35.99.Loaded with fantastic personal finance features, Quicken is undoubtedly one of the best unique accounting software.Ĭustom invoicing, tax deduction monitoring, and email alerts are among Quicken’s other functions. The app can manage personal and company expenses and property management features such as rental payments.

#REVIEW QUICKEN FOR PERSONAL USE SOFTWARE#

Quicken is among the most well-known personal finance software applications available. Quicken is a cloud-based application that lets individuals monitor property value and handle payment collection. In this article, we will be reviewing the 5 best personal accounting software. All this makes it less likely that you will lose your work. Software records are ordinarily simple to save and restore, either to your hard drive or to a cloud storage service. Using simple tools, you can streamline the entire operation. It doesn’t have to be all about checks, receipts, bills, and excel sheets when it comes to personal finance.

#REVIEW QUICKEN FOR PERSONAL USE FREE#

If you use Windows or macOS on your computer or do all of your budgeting on your phone, there’s a free option to keep track of your finances and prepare for the future below. Even the free personal finance software can be pretty resilient, allowing you to keep track of your expenses, build and maintain budgets, and generate reports. There are numerous websites and office software items that excel at handling personal finances. You must track your revenue and expenditures, as well as your budget and savings.

#REVIEW QUICKEN FOR PERSONAL USE HOW TO#

They teach you how to develop your money management skills and even find new ways to achieve your long-term financial objectives.īasic personal finance software merely acts as a platform for handling your finances, but more sophisticated features can assist with debt reduction, budget management and even offer financial advice as an added service. Personal finance tools and applications will help you learn the fundamentals of personal finance.

Personal finance is divided into five categories: income, spending, saving, investing, and insurance. A budget or financial strategy may summarise the cycle of handling one’s personal finances. For more information, please see our Privacy Policy Page.Personal finance is the planning and management of personal financial processes such as earning money, spending it, saving it, investing it, and protecting it. Our affiliate compensation allows us to maintain an ad-free website and provide a free service to our readers. This can affect which services appear on our site and where we rank them. While we strive to keep our reviews as unbiased as possible, we do receive affiliate compensation through some of our links. Our mission is to help consumers make informed purchase decisions. Clarify all fees and contract details before signing a contract or finalizing your purchase. For the most accurate information, please ask your customer service representative. Pricing will vary based on various factors, including, but not limited to, the customer’s location, package chosen, added features and equipment, the purchaser’s credit score, etc. Disclaimer: The information featured in this article is based on our best estimates of pricing, package details, contract stipulations, and service available at the time of writing.

0 kommentar(er)

0 kommentar(er)